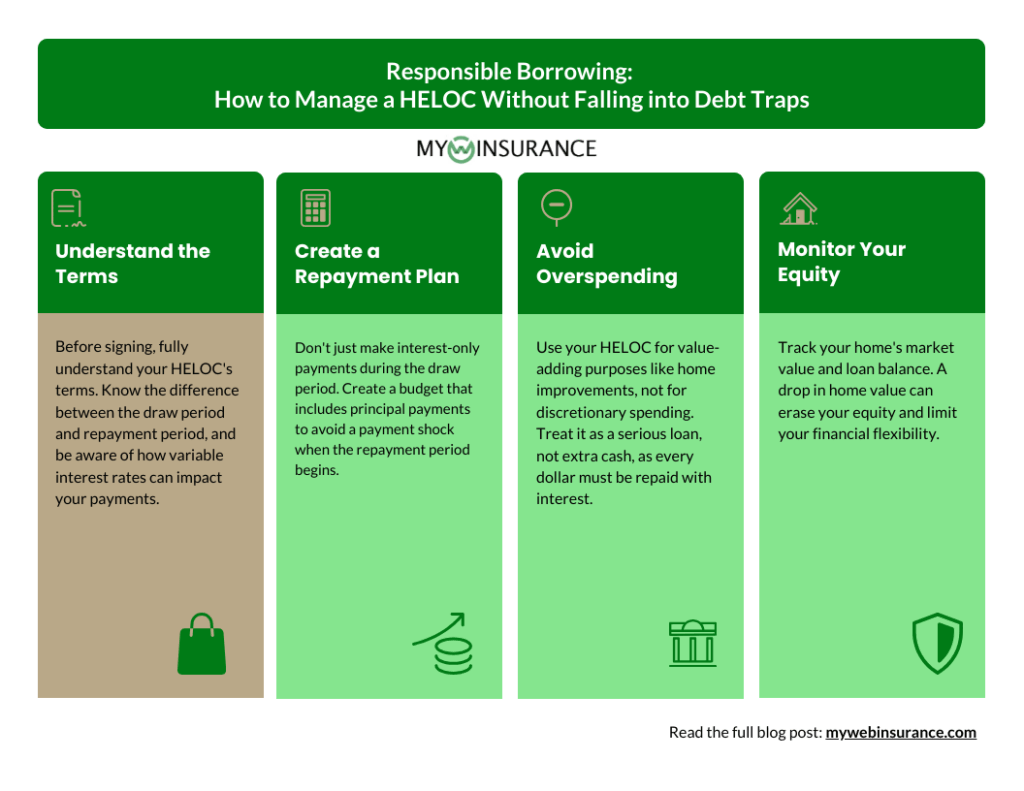

Home Equity Lines of Credit offer Canadian homeowners flexible access to funds, yet this convenience can quickly become a financial burden without proper management. Understanding how to use these credit products responsibly protects your most valuable asset while helping you achieve your financial goals.

Common HELOC Misuse Patterns

Many Canadians fall into predictable traps when managing their home equity borrowing. The revolving nature of HELOCs makes them feel similar to credit cards, leading borrowers to fund everyday expenses like groceries, dining out, or entertainment through their home equity. This behaviour transforms a strategic financial tool into an expensive way to finance temporary consumption.

Another frequent mistake involves ignoring variable interest rate fluctuations. When rates were historically low, minimum payments felt manageable. However, as the Bank of Canada adjusted its policy rate upward, many borrowers found themselves struggling with substantially higher monthly obligations. The problem intensifies when borrowers fail to adjust their repayment strategy as rates climb.

Perhaps the most dangerous pattern emerges when homeowners borrow for depreciating purchases or lifestyle upgrades that provide no lasting value. Funding vacations, vehicles, or luxury items with home equity converts short-term pleasures into long-term debt secured against your property. This approach steadily erodes the wealth you have built while increasing your financial vulnerability.

How to Build a Structured Repayment Framework

Creating a disciplined repayment plan transforms your HELOC from a potential liability into a manageable financial tool. Start by establishing a realistic monthly payment that exceeds the minimum interest requirement. Even small additional payments toward principal can significantly reduce your overall interest costs and accelerate your path to becoming debt-free.

Consider implementing automatic payments that treat your HELOC like a traditional loan rather than open-ended credit. Setting up biweekly payments aligned with your pay schedule helps you stay consistent while reducing the psychological temptation to skip payments during tight months. This structure also means you make one extra monthly payment per year, further reducing your principal balance.

Track your draws and payments meticulously through a simple spreadsheet or budgeting app. Recording the purpose of each withdrawal creates accountability and helps you evaluate whether future borrowing aligns with your financial priorities. Regular monitoring also alerts you to creeping balances before they become unmanageable.

The Role of Community Financial Institutions

Working with the right lender significantly influences your HELOC management success. When seeking home equity financing, connecting with a credit union in Saskatoon, like Innovation Federal Credit Union or other regional centres, offers distinct advantages for responsible borrowing. Member-owned cooperatives help associates understand their obligations and develop realistic repayment strategies. Their advisors take time to assess whether a HELOC truly serves your needs or if alternative financing might better suit your situation.

Credit unions typically offer competitive rates while maintaining a genuine interest in your long-term financial health. They provide accessible support when you need to adjust your repayment plan or discuss concerns about rising rates. This relationship-based approach creates natural accountability that helps borrowers stay disciplined. Furthermore, the local presence of these institutions means you can speak face-to-face with advisors who understand regional economic conditions and housing market dynamics affecting your equity position.

Why Adequate Equity Cushions Matter

Protecting your equity position requires constant vigilance and conservative borrowing habits. Financial experts recommend maintaining at least 20 percent equity in your home even when you have an approved HELOC. This buffer protects you against housing market downturns and ensures you retain ownership security regardless of economic conditions.

Calculate your loan-to-value ratio regularly by dividing your total mortgage debt and HELOC balance by your current property value. As you approach 80 percent LTV, stop drawing additional funds and focus exclusively on repayment. Remember that property values can decline, and you want a sufficient cushion to weather temporary market corrections without finding yourself underwater.

Strategic Choices for Productive Purposes

The most successful HELOC users restrict their borrowing to investments that either generate returns or increase property value. Home renovations that improve functionality or appeal represent appropriate uses, especially when the improvements enhance resale value. Similarly, consolidating higher-interest debt makes financial sense provided you commit to paying down the balance rather than accumulating new consumer debt.

Education expenses can justify HELOC borrowing when they lead to career advancement and increased earning potential. However, approach this carefully by projecting realistic salary increases and ensuring the additional income will comfortably cover repayment. Business investments require even more scrutiny, as using your home to fund entrepreneurial ventures carries substantial risk.

How to Navigate Rate Fluctuations Successfully

Variable rates define most HELOCs, making rate management essential for long-term success. Stay informed about Bank of Canada announcements and economic indicators that signal potential rate changes. When rates begin rising, immediately increase your payments to offset higher interest charges and maintain your repayment timeline.

Some lenders offer rate protection options that cap your maximum interest rate for a fee. Evaluate whether this protection makes sense based on your risk tolerance and the current rate environment. Even without formal protection, you can self-insure by building a savings buffer specifically designated for potential payment increases.

Concluding Remarks

Responsible HELOC management demands discipline, planning, and honest assessment of your financial capabilities. By avoiding common misuse patterns, you can leverage home equity effectively. Your property represents years of investment and should enhance your financial security rather than jeopardize it through careless borrowing decisions.